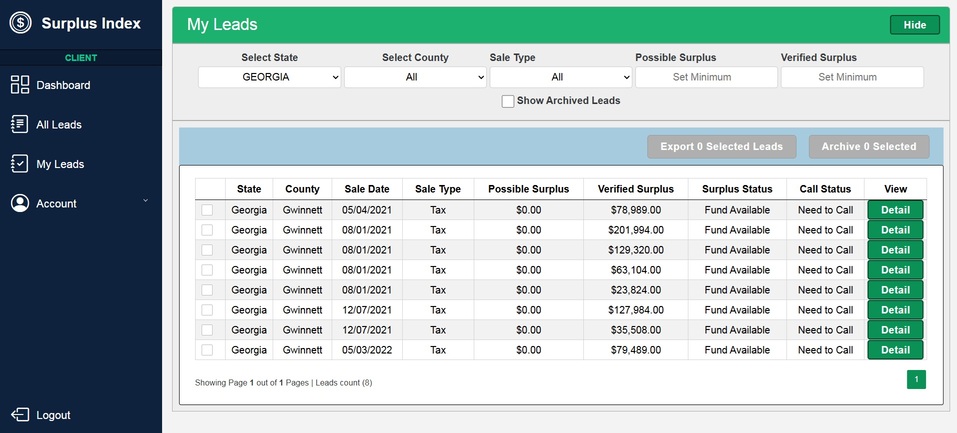

Get access to our lead management system

We just developed an outstanding database management system tailored for recovery agents. We upload all the Georgia Tax and Mortgage Sales information as leads in the database right after sale with detailed debt calculation as well as possible contacts detail.

Create an account and get access to all the leads available in our system (limited preview). You can see the details of a lead using credits available in your account. 20 free credits are provided upon creating account in our system.

We guaranty your satisfaction and provide one week money back guaranty along with cancel anytime option. Enroll now to lead the industry.

Georgia Excess Funds List

Georgia Tax foreclosure go through a judicial sale process to collect due taxes and costs. So there is a filling of judicial case to complete the sale process. Having access to court records is very useful to recovery agents to verify the availability of surplus funds without calling the court. It’s also possible to learn if any of the involved party is active in court premises and going through a claiming process to collect their portion of surplus.

On the other hand Mortgage foreclosure goes through a non judicial or power of sale process to collect lenders debt. So it’s not possible to find a list of surplus funds in any of the county network. The trustee of the loan who performs the sale , keeps the residue fund in a trust account. Funds from mortgage foreclosure can be verified by calling the trustee. It is very important for recovery agents or professionals to know about the sale process to efficiently collect high quality surplus leads.

In surplusindex.com excess funds list directory, we provide all the necessary resources a recovery agent need to do the research and verify leads. You can also enroll in our lead generation service to receive hassle free leads from all the counties of Georgia and stay up to date.

Georgia Surplus LAw

Tax Foreclosure

Title 48 – Chapter 4 – Section 5

If there are any excess funds after paying taxes, costs, and all expenses of a sale made by the tax collector, tax commissioner or sheriff, or other officer holding excess funds, the officer selling the property shall give written notice of such excess funds to the record owner ……

Mortgage Foreclosure

Title 44 – Chapter 14 – Section 125-126

The money arising from the sale of the property shall be paid to the trustee unless claimed by some other lien which by law may have priority over the deed; and, when there is any surplus after paying the sums due under the deed and other liens, the surplus shall be paid to the maker of the deed or his agent……

Excess Funds List by States

Alabama

California

Illinois

Kentucky

Massachusettes

Missouri

New Hampshire

North Carolina

Oregon

South Dakota

Vermont

Wisconsin

Alaska

Colorado

Indiana

Louisiana

Michigan

Montana

New Jersey

North Dakota

Pennsylvania

Tennessee

Virginia

Wyoming

Arizona

Connecticut

Hawaii

Iowa

Maine

Minnesota

Nebraska

New Mexico

Rhode Island

Texas

Washington

Delaware

Idaho

Kansas

Maryland

Mississippi

Nevada

New York

Oklahoma

South Carolina

Utah