Surplus funds are the residue monies from a tax or mortgage foreclosure sale after paying all the debts, court costs and sale expenditures from the sale price. If your piece of property is sold in foreclosure, you may be entitled to any remaining surplus funds after paying off all the debts and court costs. These funds remain in the courts trust account for a certain amount of time and you (owners and any lienholders) are the rightful parties to claim these funds.

Who are the priority claimants for the surplus funds

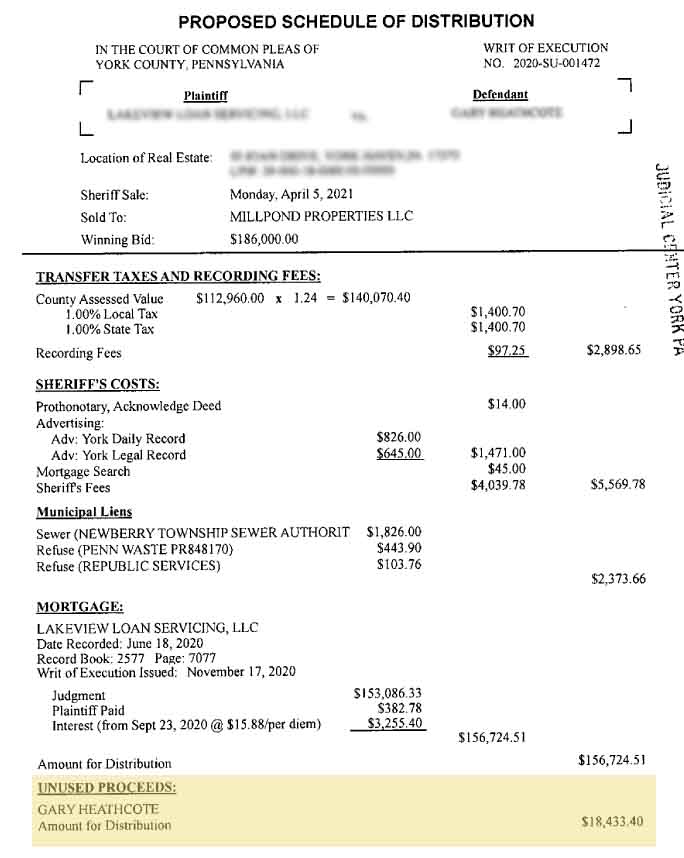

There are certain priorities to right to claim the surplus funds. Almost all the state have their own priority structure to claim surplus funds but most are almost same. In every foreclosure sale, the court executes an initial distribution of sale proceeds that pays off the attorney fees, court costs, sales taxes, due taxes, government and municipal costs and fees as well as debts to foreclosing entity. Here is an example of the initial distribution of sale proceeds,

In this image we can see taxes, sheriffs cost, municipal lien, and mortgage due is paid off from the and still remains $18,433.40 as unused proceeds may also called as surplus proceeds. After the initial distribution of sale proceeds, the surplus may be claimed by the priority claimants. Usually any government or third party lienholders are the first priority for those surplus funds. If there is not other party owing money to the piece of property, the surplus goes to the property owners at the time of sale. If you are the previous owner and want to claim surplus from your property sold in auction, it’s better to determine if there is any other party owing you money because if there are active parties who owe you more than the surplus amount, they will definitely get paid off first before you and left nothing for you. It will certainly cause you loosing money for your attorney charge and filling cost.

How do I know if my property is sold with surplus

It’s very easy to find out if your property is sold with a surplus. But before discussing it I would recommend you update your current address with the court so that you can receive all the notices and letters issued regarding your sale. If your current address is updated with the respective court, you will be notified with certified letters for all the actions taking regarding your property and sale. You can simply do it by preparing a “Notice of change of address” submit it in the respective court. Some court will allow you to prepare and submit the change of address online. Just do a simple research online or google it. But if you are not able to change address and still want to find the surpluses from your property sold in foreclosure, there are several option for that.

Call the respective department that performs the sale:

You can simply find the respective department that selling your property in foreclosure by searching it online. Some of the departments are Sheriffs, Commissioners, Contractors, Referees, Masters and so on. Just search “foreclosure sale” adding your County and State name before it and you will come up with the respective department in the result. Just visit their website and find the number to call.

Look in the county excess funds list

The county clerk prepares a list of surplus funds and upload it in their website. You can also check your property in the list. You can find the lists online by searching with your County and state name adding “excess funds list, surplus funds list or overage list” behind it. You can also find your county list in our excess funds list directory. Though this is not a good option to find surplus because Counties does not always provide a list and sometime they are updated within years. So you should try several options to find your surplus.

Do a case research

You can also find if there is any surplus funds remaining from your property sold in auction by doing a case research if the sale is occurred in a judicial foreclosure area. You can find a case search portal in our surplus funds list directory.

How to file a claim for surplus funds

When you confirmed there are certain amount of recoverable surplus funds, it’s time to file a claim to recover those funds. There are several ways you can file a claim for your surplus funds. We will discuss it in three different ways you can file a claim for your surplus funds.

Hire an attorney or law firm to file a claim

Hiring an attorney or law firm is the most convenient way to file a claim for your surplus funds. In this way you hire an attorney or law firm who will perform any filling requirements and will attend the hearings as your representative. It’s more secured to hire an attorney or law firm than filling a pro se claim for surplus funds. It also have some cons like you may loose $3,000 to $4,000 attorney fee or law firm charge if there is no surplus or priority lien holders to the full entitlement of the surplus funds. So you have to be very careful before hiring an attorney that there remains certain amount of surplus and not priority lienholders for the full entitlement of the remaining funds. You can determine your open and unsatisfied mortgages and liens by taking an assessment by your own via the county recorders search portal. You can also hire an expert freelancer to do this for you. If you can determine there will be profitable amount of surplus funds now it’s time to consult with an attorney or law firm. There are several of them who provides a free consultation about your case.

Assign a recovery agent to file a claim for me

You can also get in a fee agreement contract with surplus recovery agent or agencies. There are plenty of them whom are always looking to help you recover your surplus funds. This is a free of cost method to recover your surplus funds. Usually the recovery agent or agency you agreed to work with will bear all the expenses to claim your surplus funds including, attorney fees, filling costs and others. They will charge you a gross commission over the net recovered amount. The commission varies from 20% to 50% based on their popularity and success rate.

I want to file a claim for my own surplus

This will be the most cheap and convenient way to recover your surplus funds. It is also recommend by the court that your file a claim yourself. If you are willing to visit court several time and have some technical skills like preparing documents, dealing with notaries and mailing letters, this could save you a big portion of your surplus funds. Almost each and every county have a clear guideline about how to file a claim for surplus funds. You will also find a motion to claim surplus funds blank template in the county site as well. Some county provides an online form to fill in to claim surplus funds are more easier. We also help foreclosed homeowners find their surplus as well as provide a free assessment on their surplus funds status. Just fill in the form below to get a free assessment of your surplus funds.