Ohio Excess Funds List

What do SurplusIndex provide?

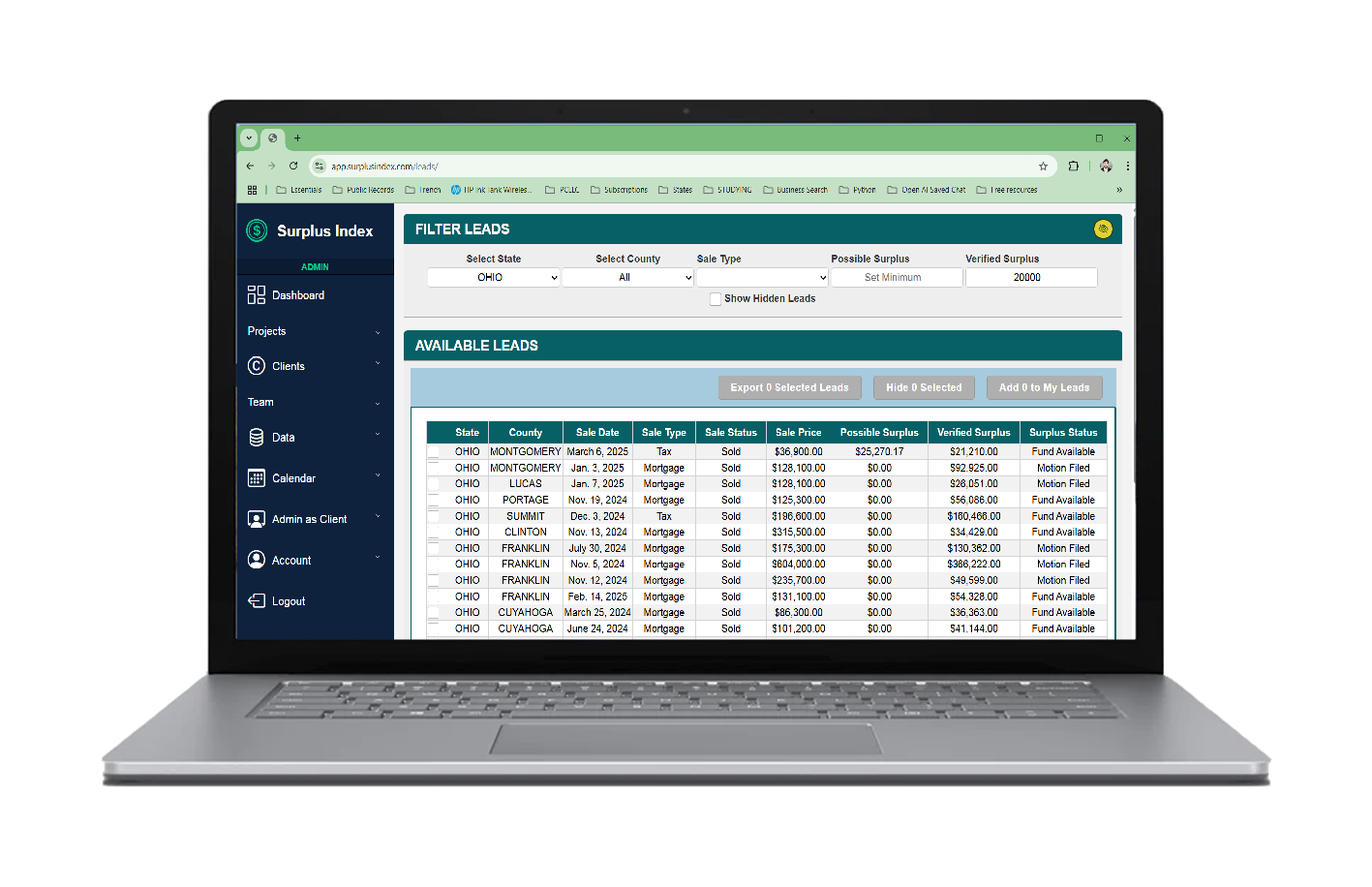

Here at SurplusIndex, we managed to build a website and contact directory that might be really helpful for overage recovery agents who intend to work in Ohio as recovery partner. Not only this, we implemented a subscription based lead generation service that will literally bring every property details that is sold in auction. Our service comes with a built in CRM that will allow you to download and manage leads as well as receive routine updates about the sale and availability status.

Enroll now to stay ahead of the competition…

Ohio Foreclosure at a glance!

Ohio is a judicial foreclosure area where foreclosure auctions are performed by either Sheriffs department (Online), Treasurer (Lobby) or Private Selling Officers (Online) under the supervision of County Civil Court. It’s one of the most preferred State for recovery agents because of the availability of resources and legal clarity. Ohio claiming process is easier and the quick turnaround time is also a blessing for recovery agents.

Related Statutes for Foreclosure and Surplus Funds

Ohio uses a court-supervised (judicial) foreclosure process. After a foreclosure judgment, the property is sold at a sheriff’s sale. The proceeds from that sale are used to pay: 1. The mortgage debt, 2. Taxes and court fees 3. Other valid liens

If money remains after these obligations are paid, it becomes surplus funds, which are held by the Clerk of the Court.

Application for, and distribution of, surplus money held by the clerk of the court shall be made in accordance with Ohio Revised Code §§ 2329.44 through 2329.52 and the applicable Rules of Court.

Ohio Subscription Based

lead generation service

Keep your database up to date with real time data, meaningful statuses, reliable and accurate information from authentic sources. All our Ohio monthly subscription plans include data from 140 + sources. Leads from Tax and Mortgage foreclosures performed by Sheriff or Private Selling Officer is included. Well formatted, clean and organized data from reliable sources. Customized Excel sheet along with SurplusIndex dashboard access is provided as deliverables.

Basic

Subscription Plan- Verified Surplus List

- Unlimited Status Update

- 140+ Auction Source

- 4 Weekly Update

- Dashboard Access

- 100-200 Leads / Month

- Skiptraced Contact

Standard

Subscription Plan- Basic + Post Foreclosure

- Unlimited Status Update

- 140+ Auction Source

- 2x4 Weekly Update

- Dashboard Access

- 200-300 Leads / Month

- Skiptraced Contact

Premium

Subscription Plan- Standard + Pre-Foreclosure

- Unlimited Status Update

- 140+ Auction Source

- 3x4 Weekly Update

- Dashboard Access

- 500+ Leads

- Skiptraced Contact

Our research methodology at a glance!

Pre-Foreclosure Update

>> We populate our database with foreclosure ads, usually after the order of sale is issued and a sale date is announced.

>> We deepsearch those properties in reliable source looking for foreclosed owner (verified with a valid deed or transfer record), final judgment amount, and any other outstanding balances from Mortgage, Taxes or Liens.

>> We use paid Skip-tracing tools to find contact information like wireless numbers, landline or emails.

Finishing this step comes with an outstanding pre-foreclosure list (we prepare them at least one week before sale). The list consists verified owners detail, property detail, civil case detail, appraised value, final judgment, other outstanding balances, and owners contact info(skiptraced).

Post Foreclosure Update

>> Whenever a sale date is past we update the sale status of the pre-foreclosure leads we generated before.

>> We remove those leads that haven't been sold in auction, cancelled, bankruptcy hold, or if the plaintiff buy back the property to cover up the judgment.

>> We only keep those leads, where the property is sold in auction to a third party bidder for more than the property owner owed.

This comes with a polished post-foreclosure list consisting auction sale info, owners detail, property detail, civil case detail, appraised value, final judgment, other outstanding balances, sale price, and owners contact info(skip-traced).

We assume those leads with a high chance of having surplus balance after the initial distribution. But we don't guarantee the availability of surplus there.

verified surplus funds list

>> In our post foreclosure database, we do a routine check of those cases for the court distribution order is filed.

>> We exclude anything where there is no surplus balance or disbursed instantly.

>> We also merge the county provided excess funds list to prepare a verified excess funds list.

>> We do not end here. We keep updating those verified leads until the surplus balance is fully distributed from the treasurer's trust account in the name of prior owners or any lienholders.

>> You can find status updates using our software (access will be provided upon subscription)

So here comes the verified list consisting verified surplus balance detail along with other details mentioned earlier.

Note that: We only deliver pre-foreclosure, post-foreclosure and verified list via email for each respective subscription. Status updates can be self accessible using our app.